Question 1: Which financial management policies were approved by the board in March 2023?

Question 2: When do these policies need to be implemented?

These policies must be implemented by the end of Fiscal Year 2024.

Question 3: How should divisions approach deficit curing?

Divisions should work with departments, centers, and other entities within the division to align revenues and expenses at the lowest chart level prior to fiscal year end close.

Question 4. I record revenues at the funds center level, expenses at the funded program level, and collapse them at year end. Is this still permitted?

Yes. If revenues at the funds center level are sufficient to fund the expenses at the related funded program level, and are closed together at year-end, this is still permissible. If revenues are less than expenses, additional action would be required (see Question 3).

Question 5. What happens if I have a deficit at quarter-end but expect to cure it by fiscal year end?

No action is required. Divisions are required to review funded programs / fund centers for deficits quarterly. Only deficits expected to remain uncured at fiscal year end should be reported to the Controller’s office.

Question 6. Are certain fund types excluded from the Accumulated Deficit Balances Policy?

The policies apply to all fund types, but certain fund types are treated differently:

- FT14: Currently managed via the Special Ledger and subject to service center monitoring processes

- WBS Elements: Divisions should record expenses in the WBS element and record offsetting funding in the WBS element’s parent cost center

- Sponsored Cost Share & Cost Overrun: Divisions should coordinate with Paul Gasior and the Sponsored Awards team to cure deficits in these accounts

Question 7. What sort of time commitment will implementation require for divisions and departments?

Divisions should anticipate three 90-minute working sessions with the Controller’s office / Huron to review and discuss current practices and implementation approaches. Additional work will be needed outside those meetings to implement the policies, but the extent of that work and which parties should participate (e.g., division staff, department staff, etc.) will vary by division. Assistance is available, should you need it.

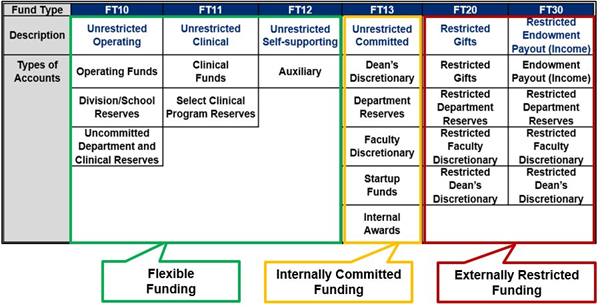

Question 9. Are there recommendations for fund type alignment of cost objects?

Question 10. What is the difference between fund type 10 and fund type 13?

Fund type 10 represents the annual operating budget and any resulting surpluses accumulated in division reserves over time. Fund type 13 represents unrestricted, internally committed funds.

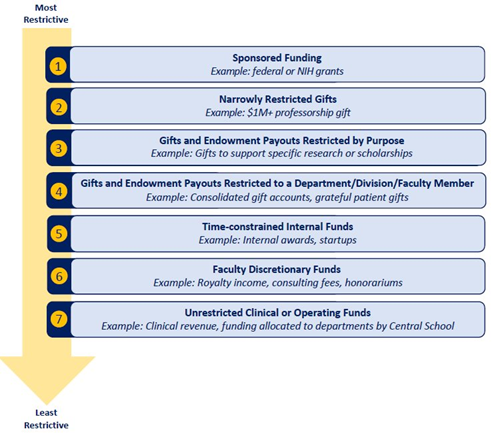

Question 12. What is the “First Dollar Principle” referenced in the Restricted Funds Management policy?

The First Dollar Principle is an accounting best practice that states the most restricted dollar must be used first for applicable expenses. This means that for any expense, the most restrictive sources of funding applicable must be used before spending funds with fewer or no restrictions. The below flowchart can be used as a reference.

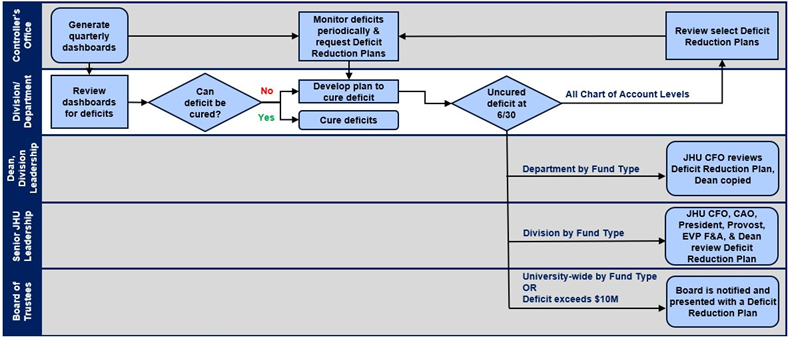

Question 13. What is the process for monitoring deficits and submitting deficit reduction plans?

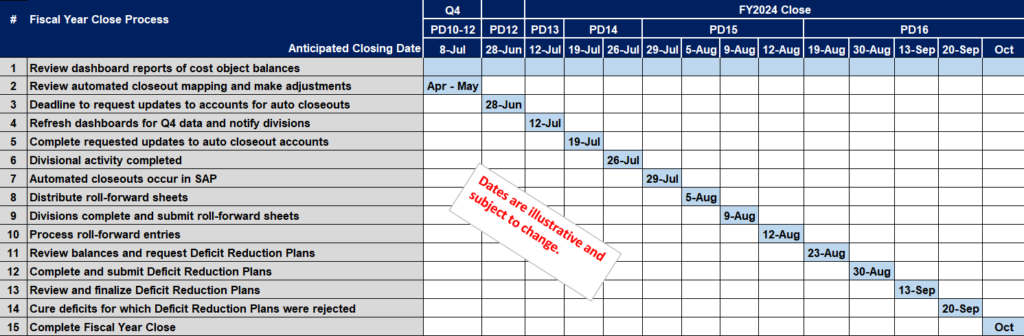

Question 14. How do the policies impact the fiscal year end close timeline?

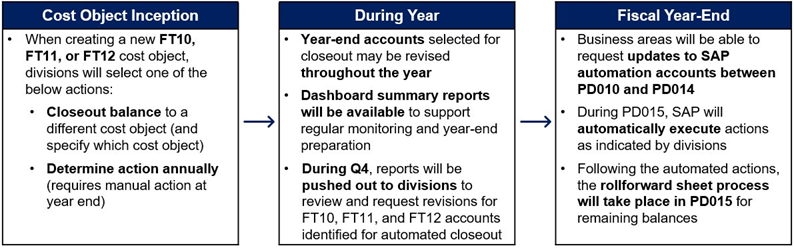

Question 15. What are SAP Automated Closeouts?

An automated year end closeout process for Fund Types 10, 11, and 12 is under development to support policy compliance and reduce administrative burden for divisions. The manual rollforward process will still be available to divisions during fiscal year end close and will occur following automated closeout entries.

Question 16. Why are we realigning accounts to different and new fund types?

Per the Chart of Account Governance Policy, university accounts must be appropriately aligned with the account structure in the Fund Type Alignment matrix (see Q9). The goal of aligning accounts based on this matrix is to ensure that unrestricted and restricted resources are appropriately and consistently aligned to the definitions of the fund types. The alignment of accounts to new fund types does not change the amount or ownership of the accounts, it just changes how the fund is categorized and potentially named.

For example, a cost object with restricted gift funding that is in FT13 would move to FT20 through the realignment process. The cost object itself would not change. Rather, the cost object would be move to a new fund in FT20 and the associate gift funding would be transferred to this new fund-cost object combination. This action will move the funding to the correct fund type and preserve the historical record in SAP.

The below GL codes will be used for balance transfer entries related to fund type alignment.

- 650081 – Unrestricted

- 650082 – Temporarily restricted

- 650083 – Permanently restricted

Question 17. How will funded programs be realigned to new fund types? Will new funded programs be created?

New funded programs will not be created for every fund type alignment. Instead, the SAP fund derivation rules will be updated such that the funded program will be mapped to the new fund type (e.g., a gift-funded program’s fund will be updated from a Fund 13 to Fund 20). Updating the SAP derivation rules allows the historical activity record to remain intact.

Question 18. When will fund type alignment occur for JHU divisions and schools (excluding the School of Medicine)?

Staff in the Controller’s Office and Huron Consulting are currently working with divisions to gather the population of accounts for alignment. The current target date for alignment is May 2024. The project team will continue communicate and partner with impacted divisions and schools on a regular basis throughout the alignment process.